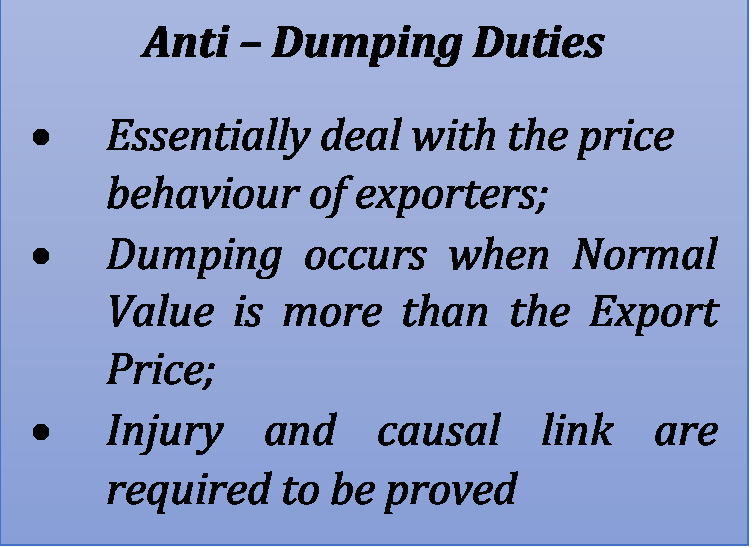

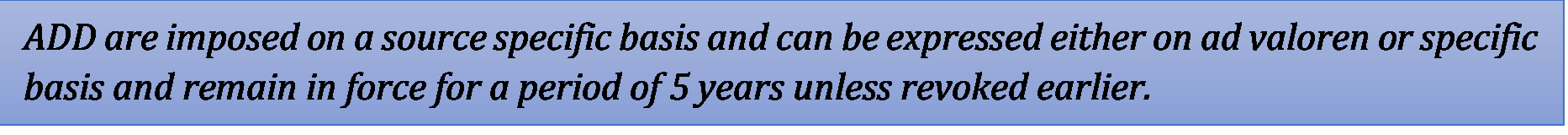

This offering from Aureus Law Partners seeks to present a primer on Anti-Dumping Laws and procedure in India. Anti-Dumping Duties (“ADD“) are imposed to counter dumping of goods or articles in India causing material injury to the domestic industry. Hence, the imposition of ADD is driven from Government’s intent to provide expeditious relief to the domestic producers from the trade-distorting phenomenon of dumping.

ADD measures are different from the ‘Safeguard’ measures where the requirement to establish ‘material injury’ is more stringent, and when duties of safeguard are imposed, Exchequer may also be required to pay compensation to the trading countries. For the purposes of this article, we have limited ourselves to law and procedure relating to ADD in India.

Legal Framework

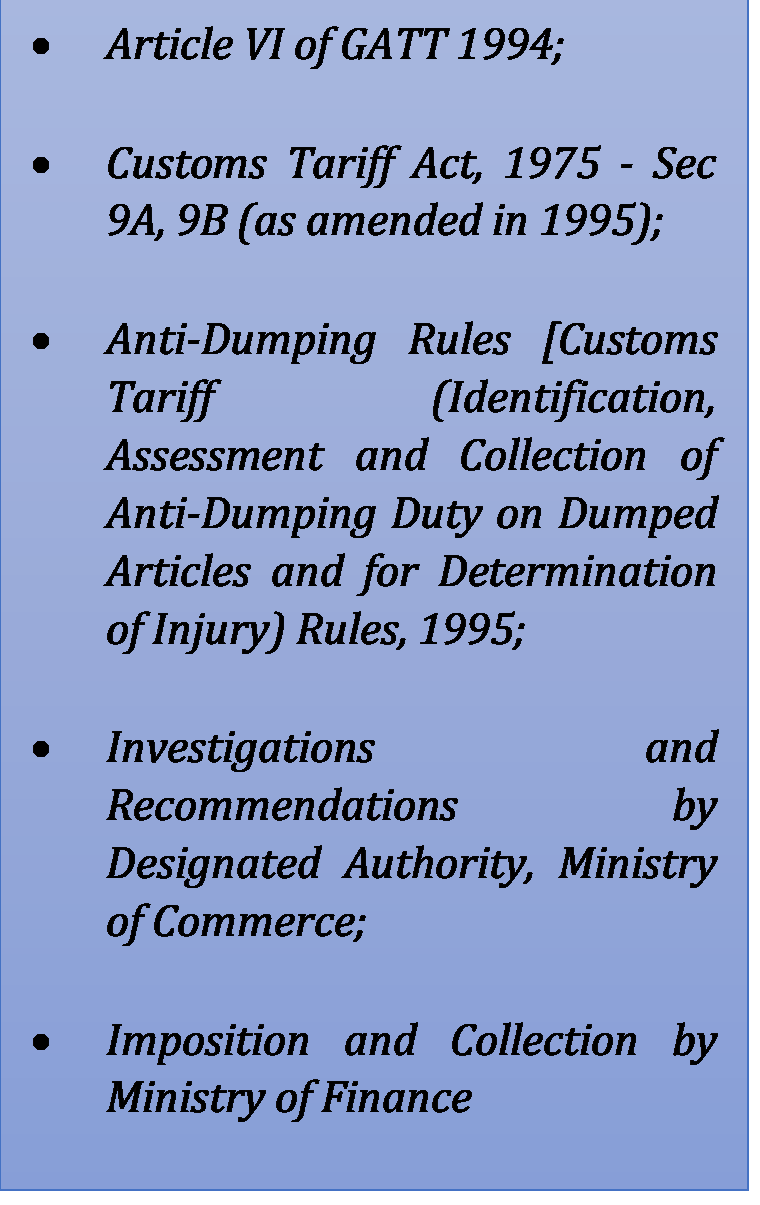

Member nations of the World Trade Organisation have agreed to the General Agreement on Tariffs and Trade of 1994 (“GATT”). As per Article VI of GATT, 1994 read with Anti-Dumping Agreement, WTO member states can impose anti-dumping measures subject to conditions.[1]

Indian laws were amended with effect from January 1, 1995 to align the national law with the Article VI of GATT and specific agreements between the member nations.

Sections 9A, 9B and 9C of the Customs Tariff Act, 1975 (“Tariff Act”) as amended in 1995 and the Customs Tariff (Identification, Assessment and Collection of Anti-Dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995 (“ADD Rules”) framed thereunder constitute the legal basis for anti-dumping investigations and for the levy of anti-dumping duties.

Currently, given the slowdown faced by the domestic industry due to the COVID pandemic and ensuing decrease in cross-border trade, there has been upward trend in imposing ADD on several items of import. In 2021 itself, the Ministry of Finance until March 11 has issued more than 10 notifications imposing ADD on several items of import (primarily from China PR).

What is ‘Dumping’

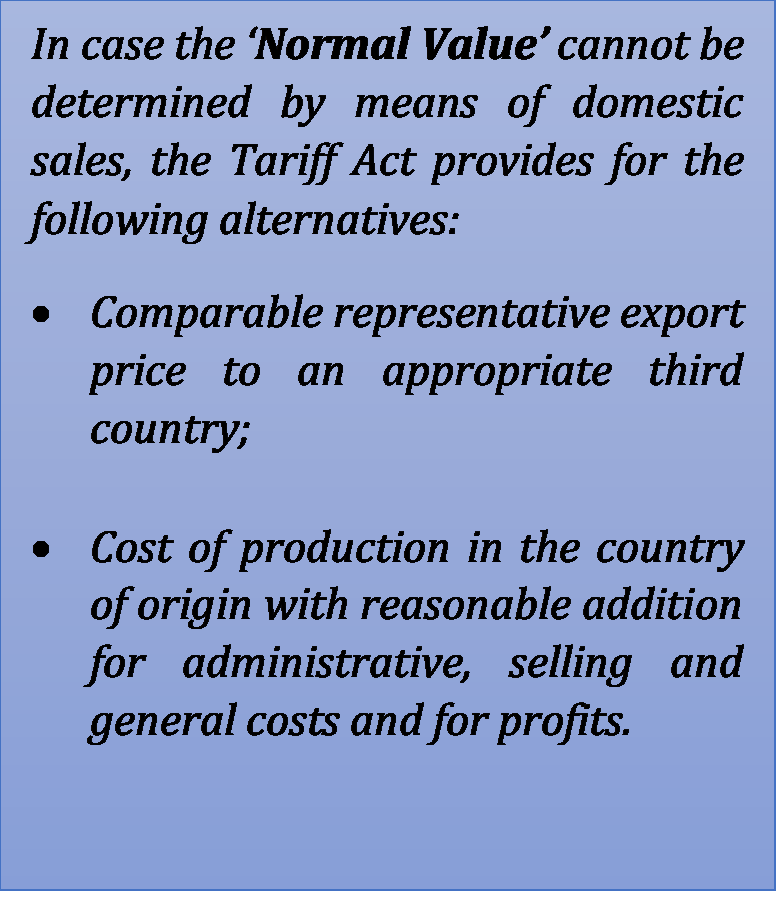

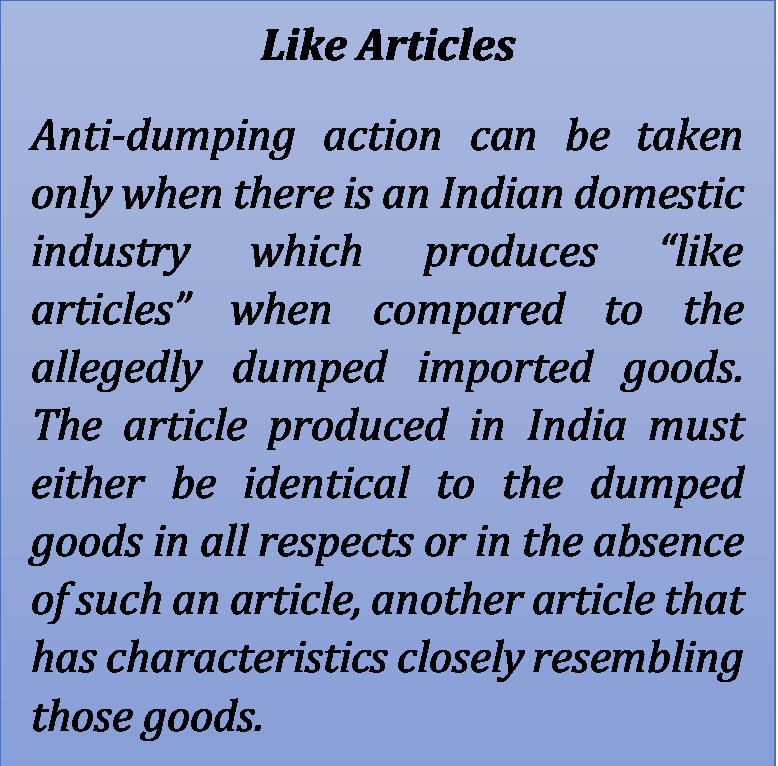

Dumping occurs when the ‘Export Price’ of goods imported into India is less than the ‘Normal Value’ of ‘like articles’ sold in the domestic market of the exporter. The ‘Normal Value’ refers to the comparable price at which the ‘product under consideration’ (“PUC”) are sold, in the ordinary course of trade, in the domestic market of the exporter.

The ‘Export Price’ of goods imported into India /PUC is the price paid or payable for the goods by the primary independent buyer. Principles governing the determination of “export Price’ include – (i) Arm’s Length Transaction; (ii) Resale price to an independent buyer[2]; and (iii) Price determined on a reasonable basis[3].

‘Margin of Dumping’ refers to the difference between the Normal Value of the like article and the Export Price of the PUC. These are normally determined on the basis of – (i) a comparison of weighted average Normal Value with a weighted average of prices of comparable export transactions; or (ii) a comparison of ‘Normal Value’ and ‘Export Price’ on a transaction to transaction basis[4].

The ‘Export Price’ and the ‘Normal Value’ of the PUC are to be compared at the same level of trade i.e. ex-factory price, for sales effected during the nearest possible time. Due consideration is also made for differences that affect price comparability of a domestic sale and an export sale. These factors, inter alia, include – (i) physical characteristics; (ii) levels of trade; (iii) quantity; (iv) taxation; (v) conditions and terms of sale.

It is pertinent to note that the said factors are only indicative and any other factor which can be demonstrated to have an effect on the price comparability, may be considered.

Injury to the Domestic Industry

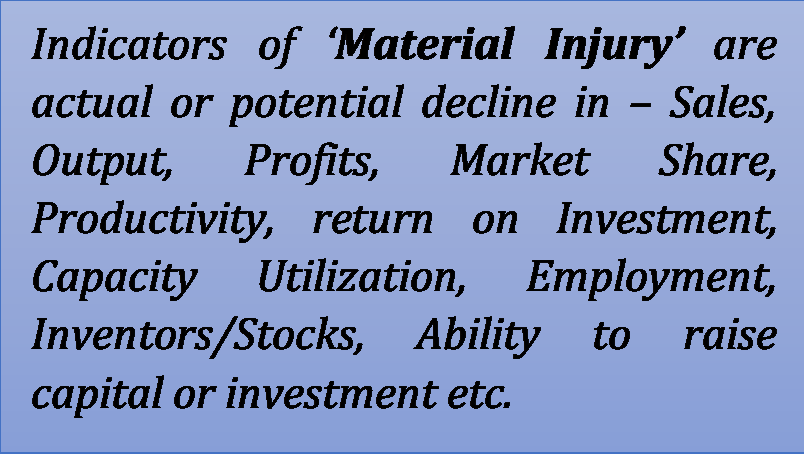

The Indian domestic producer must show that dumped imports of PUC are causing or are threatening to cause ‘material injury’ to the Indian ‘Domestic Industry’[5].

Broadly, the principles governing the determination of ‘material injury’ because of alleged dumping are – (i) PUC has been exported to India from the subject country below its ‘Normal Value’; (ii) Domestic Industry has suffered ‘material injury’; and (iii) There is a casual link between the alleged dumping and ‘material injury’ caused to the Domestic Industry. Also, the analysis of ‘material injury’ is undertaken by following two methods:

Volume Effect

Examination of volume of the dumped imports, including the extent to which there has been or is likely to be a significant increase in the volume of dumped imports. These may be either in absolute terms or in relation to production or consumption in India, and its effect on the Domestic Industry.

Price Effect

The effect of dumped articles on prices in the Indian domestic market including price-undercutting, price depression or preventing increase in price which otherwise would have increased.

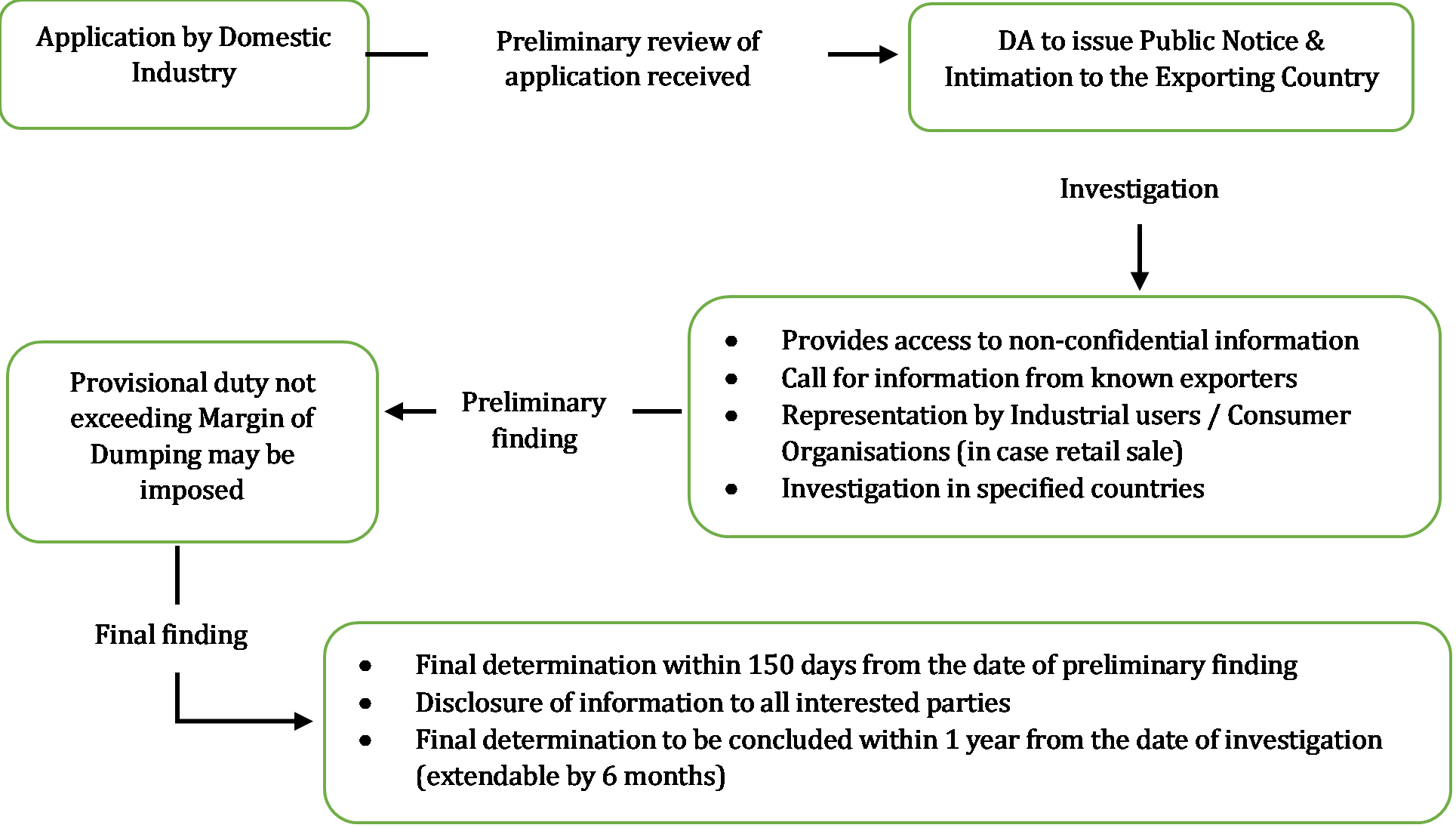

Investigation for imposing ADD

An investigation for alleged dumping may be initiated by the Designated Authority upon an application made by or on behalf of Domestic Industry.[6] Following two conditions are pre requisites for a valid application to be considered by the Designated Authority:

- Application must be supported by domestic producers accounting for not less than 25% of total production of the like article in India; and

- Domestic producers supporting the application must account for more than 50% of total production of like article by those opposing the application.

Miscellaneous Provisions

Termination of Investigation

- Request in writing from the Domestic Industry at whose instance the investigation was initiated;

- No sufficient evidence of dumping or injury;

- If the Margin of Dumping is less than 2% of the Export Price;

- If the volume of dumped imports from a country is less than 3% of the total imports of the like article into India or the volume of dumped imports collectively from all such countries is less than 7% of the total imports;

- Injury is negligible.

Retrospective imposition of ADD

- If there is a history of dumping which caused the injury or that the importer was, or, should have been aware that the exporter practices dumping and that such dumping would cause injury, and

- If the injury is caused by massive dumping, in a relatively short time, so as to seriously undermine the remedial effect of anti-dumping duty.

Such retrospective application will not go beyond 90 days of the date of imposition of provisional duty.

Refund of collected duty

- If the imposed ADD on the basis of final findings is higher than the provisional duty (already imposed and collected), the difference shall not be collected;

- If the final ADD is less than the provisional duty (already imposed and collected), the difference shall be refunded;

- If the provisional duty is withdrawn based on a negative final finding, then the provisional duty already collected shall be refunded.

Contributed by Manish Parmar. Manish can be reached at manish.parmar@aureuslaw.com.

Views are personal.

[1] Pursuant to investigation in accordance with the Agreement, a determination is made (a) that dumping is occurring, (b) that the domestic industry producing the like product in the importing country is suffering material injury, and (c) that there is a causal link between the two. In addition to substantive rules governing the determination of dumping, injury, and causal link, the Agreement sets forth detailed procedural rules for the initiation and conduct of investigations, the imposition of measures, and the duration and review of measures.

[2] If there is no export price or the export price is not reliable because of association or a compensatory arrangement between the exporter and the importer or a third party, the export price may be determined on the basis of the price at which the imported articles are first resold to an independent buyer.

[3] If the PUC are not resold as above or not resold in the same condition as imported, their export price may be determined on a reasonable basis.

[4] Introduced after the Uruguay Round.

[5] Rule 2(b) of ADD Rules.

[6] Under Rule 5(4) of ADD Rules, the Designated Authority may also initiate investigation suo motu based on information received from Customs authorities or any other person.