How to file a PIL

How to File a Consumer Complaint Online? 6 Things to Know

How To File an FIR/ Police Complaint? A Guide

High Court Denies Refund of Credit under Inverted Duty Structure

In a recent judgment of Madras High Court in the case of TVL Transtonnelstroy Afcons Joint Venture v. UOI,[1] the Court denied refund of tax paid on input services on account of inverted tax structure. This marks significant blow to taxpayers who operate under ‘inverted duty structure’, and have been claiming refund on account of paying higher rate of tax on input supply. Earlier in July, the Gujarat High Court in VKC Footsteps India Private Limited v. UOI[2], had read down the explanation (a) to Rule 89(5) of Central Goods & Services Tax Rules, 2017 (“Rules”), and had allowed refund of tax paid on input services as well.

What is “Inverted Tax Structure”?

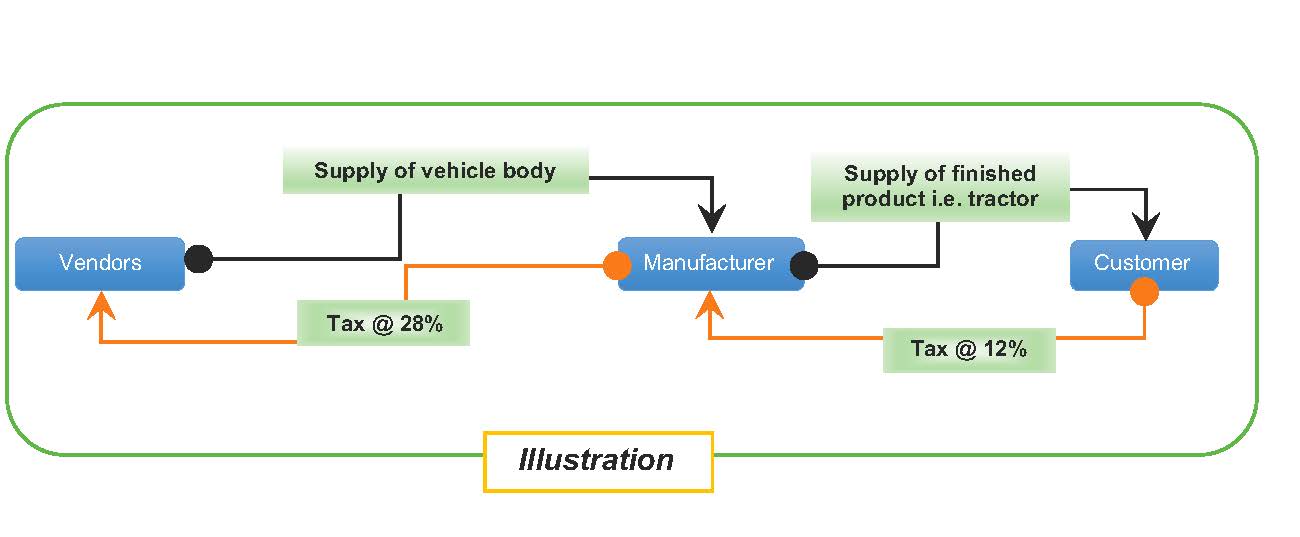

Inverted Tax Structure is a situation where the supplier pays higher rate of tax on its input supplies, and discharges comparatively lower rate of tax while making its output supply. Consequently, a large pool of credit of tax paid on input supplies is accumulated. This would result in cascading effect of taxes in the form of unabsorbed excess tax on inputs with consequent increase in the cost of product which is against the very tenet of GST being a consumption tax. In order to address the said anomaly, GST law provides for refund of accumulated unutilised input tax credit (“ITC”).

Issue

Section 54 of the Central Goods and Services Tax Act, 2017 (“Act”) provides for refund of GST in certain cases. Sub-section (3) provides for refund of unutilized ITC in cases of zero rated supplies and ITS i.e. where credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies. ITC has been defined under Section 2(63) of CGST Act to mean credit of ‘input tax’. Section 2(62) defines ‘input tax’ to mean tax charged on supply of goods and / or services. Accordingly, the taxpayers were eligible to claim refund of unutilised ITC accumulated due the inverted tax structure basis the formula prescribed under Rule 89(5) of CGST Rules. Said rule was amended with retrospective operation from July 1, 2017 by an amendment introduced in 2018 to exclude ‘tax paid on input services’ from the meaning of ‘Net ITC’. In effect, the amended Rule 89(5) by employing the expression “input tax credit availed on inputs’, has the effect of granting refund of tax paid only on ‘inputs’ and denying the same on ‘input services’. Said amendment was challenged in multiple proceedings by contending that amended Rule 89(5) by restricting the refund to ‘inputs’ only, runs contrary to the substantive provision i.e. Section 54(3), and is ultra vires to this extent.

Gujarat High Court’s view in the VKC (supra)

Court observed that Section 54(3) employs the expression ‘any unutilised input tax credit’, and ITC is defined under Section 2(63) to mean credit of input, and ‘input tax’ as defined in Section 2(62) means central tax, state tax, integrated tax or union territory tax charged on any supply of goods and / or services. Hence, Section 54(3) must be read to include tax paid on input services as well. Accordingly, upon conjoint reading of Act and Rules, Court held the explanation (a) to Rule 89(5) ultra vires the provision of Section 54(3), and observed that by prescribing formula under the Rules, the Executive cannot restrict the substantive provision enacted by the Legislature. Accordingly, Revenue was directed to process the refund of unutilised ITC by including the tax paid on ‘input services’ as well.

Madras High Court’s view in TVL (supra)

Madras HC did not subscribe to the view taken by the Gujarat HC in VKC (supra) by observing that the import of proviso to Section 54(3) was not discussed in VKC (supra). It was observed that Section 54(3) undoubtedly enables a registered person to claim refund of any unutilised ITC. However, the principal of the said enacting clause is qualified by the proviso which states that "provided that no refund of unutilised input tax credit shall be allowed in cases other than". It was observed that unless a registered person meets the requirements of clause (i)[3] or (ii)[4] of Sub-section 3, no refund would be allowed. Under clause (ii), the expression used is ‘inputs’, which must mean to include goods[5] only and not input services[6]. Hence, Explanation to Rule 89(5) by prescribing the formula, thereby limiting the ambit of ‘Net ITC’ to mean tax paid on ‘inputs’ only, is valid and vires to Section 54(3).

Court also observed that refund is a statutory right, and the Parliament is within its legislative competence to impose a source-based restriction in order for a supplier to be eligible for refund of unutilized ITC.

Conclusion

Fundamental principle behind the overhauling of erstwhile indirect tax regime by replacing it with much-awaited GST law, was to remove cascading effect of taxes by way of set-off in order to ensure continuous chain of credits from supplier to the last retail point. Law relating to credits has evolved over time as CENVAT was introduced in place of MODVAT to allow of credits of service tax as well. Under the GST regime as well, un-amended Rule 89(5) did not differentiate between the taxes paid on ‘inputs’ and ‘input services’. However, the restriction imposed by retrospective amendment to Rules, seeks to create a source-based parameter for refund entitlement of unutilised ITC.

In view of the dissenting views of Madras HC and Gujarat HC, Supreme Court’s decision on the constitutionality of said amendment remains to be seen. In the meantime, taxpayers may continue to claim refund of unutilised ITC relating to ‘input services’ as time limit for claiming such refund is only two years.

Contributed by Manish Parmar. Manish can be reached at manish.parmar@aureuslaw.com.

Views are personal.

[1] Madras High Court’s decision dated September 21, 2020

[2] Gujarat High Court’s decision dated July 24, 2020

[3] (i) Zero rated supplies made without payment of tax;

[4] (ii) Where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies (other than nil rated or fully exempt supplies), except supplies of goods or services or both as may be notified by the Government on the recommendations of the Council:

[5] Section 2(59) of CGST Act defines ‘input’ to mean goods other than capital goods used or intended to be used by supplier in the course or furtherance of business;

[6] Section 2(6) of CGST Act defines ‘input services’ to mean services used or intended to be used by a supplier in course or furtherance of business;

Faceless Assessment of Taxpayer – What you need to know.

How to File a Consumer Complaint

New Consumer Law for the New Age Consumer

Privacy as a Constitutional Right

Goods & Services Tax – A Snapshot

Contributed by Manish Parmar.

For any queries, Manish can be reached at manish.parmar@aureuslaw.com