With a view to aid struggling businesses in wake of the COVID-19 pandemic and consequent nation-wide lockdown, Government of India has introduced two major amendments under the Insolvency and Bankruptcy Code, 2016 (“IBC / Code”). It has suspended functioning of Sections 7, 9 and 10 for 6-months and further granted exemption to transactions which may be deemed as wrongful trading transactions under Section 66(2), during this period. These amendments were brought into effect vide the Insolvency and Bankruptcy Code (Amendment) Ordinance, 2020 dated June 5, 2020 (“Ordinance”). The Ordinance can be accessed here.

Section 10A – Analysis

Sections 7 and 9 relate to insolvency proceedings against corporate persons by financial creditors and operational creditors. Section 10 relates to insolvency proceedings initiated by corporate debtor against itself.

By way of this Ordinance, Section 10A has been introduced under IBC. It states that in relation to Sections 7, 9 and 10, no application to initiate corporate insolvency resolution process (“CIRP”) shall be filed for defaults occurring on or after March 25, 2020 till a period of 6-months. It stipulates that this period may be extended, but not beyond 1-year. The Ordinance further clarifies that no application could ever be filed in relation to defaults for aforementioned period. Further, Section 10A would not apply to defaults occurring prior to March 25, 2020.

Hence, Section 10A stipulates three things; one, default occurring between March 25, 2020 and September 25, 2020 or March 25, 2021 (if extended) (“exempt period”) would not be considered as default. Two, for this period, no corporate person could ever be brought under ambit of IBC. Three, defaults occurring prior to March 25, 2020 would not be affected by Section 10A, and fresh proceedings therein may be filed.

Remedy suspended for exempt period, claim remains intact

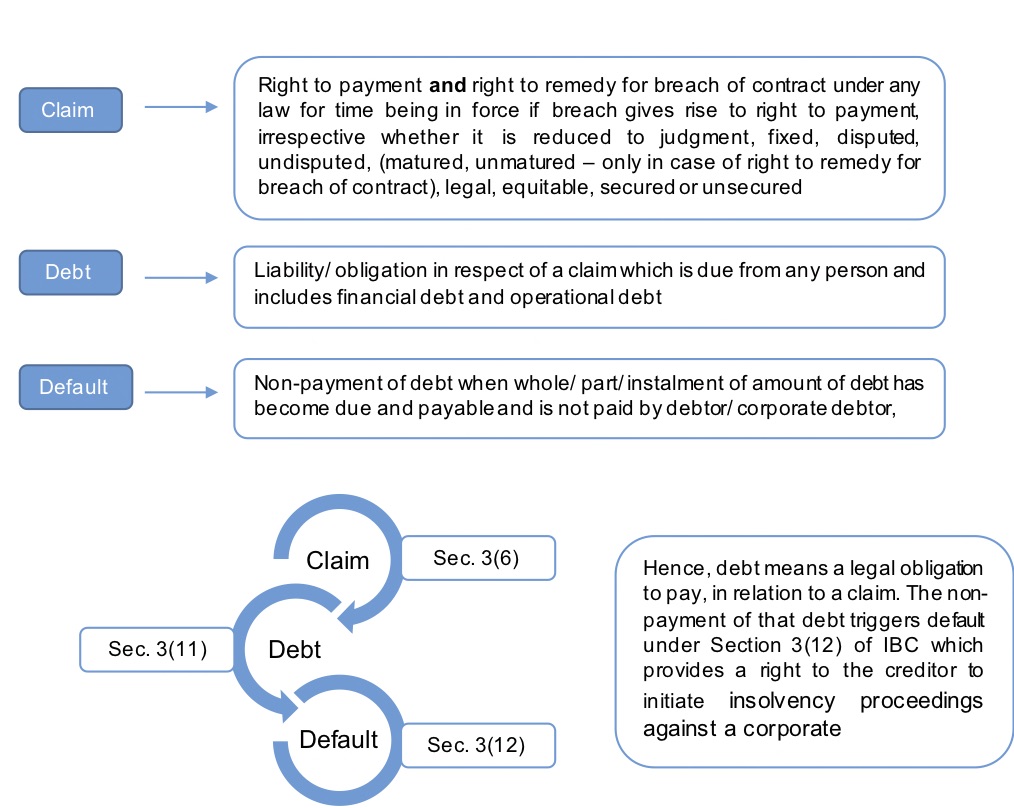

The introduction of Section 10A would effectively eliminate defaults committed during the exempt period from being considered for the purposes of bringing a corporate person under IBC in future. However, the question which arises is whether this would mean that claims arising vis-à-vis defaults committed during such exempt period would stand extinguished completely. For this purpose, it becomes pertinent to understand claim, debt and default as provided under IBC, which has been explained in the diagram herein below:

The Ordinance however, categorically states that filing of petitions for defaults committed during the exempt period is not allowed. It does not state that those amounts can never be claimed or cannot be ‘debt’ under IBC.

Therefore, when default continues beyond the exempt period, and aggregate amount of default (after eliminating default amount during exempt period) comes upto INR 1 crore, the creditor can initiate insolvency proceedings. However, this exclusion could be interpreted to be applicable only vis-à-vis filing of applications and it may not have an impact on claims filed before the Resolution Professional (“RP”) once CIRP has commenced.

Hence, it would appear that merely the remedy available to a creditor for bringing a corporate person under IBC has been suspended with respect to defaults during the exempt period. The creditor’s right to claim amounts in relation to these defaults would remain intact.

No effect on other proceedings under IBC or parallel remedies

Section 10A only suspends the functioning of Sections 7, 9 and 10 of IBC for the exempt period. It does not touch upon other proceedings under the Code, which may continue to function normally. For instance, proceedings already pending under these aforementioned sections wherein CIRP has been admitted or application is reserved for orders; applications required/ made during the course of CIRP; initiation of liquidation proceedings under Section 33; initiation of insolvency resolution process against personal guarantors under Sections 94 and 95 and initiation of bankruptcy against personal guarantor under Section 121, etc.

Additionally, the remedies available to a creditor other than under IBC may still be availed. Viz. a suit for recovery under provisions of the Code of Civil Procedure, 1908; proceedings under Recovery of Debts and Bankruptcy Act, 1993, proceedings under Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002, etc. would not be affected by promulgation of the Ordinance.

Section 66(3) – Analysis

Section 66 of IBC allows the Adjudicating Authority (“AA”) to declare any third persons (in case of fraudulent trading transactions) and directors/ partners (in case of wrongful trading transactions) liable for such transactions. Under the said section, the AA is empowered to pass orders to this effect upon an application by the RP under Section 66(1)(2).

Vide the Ordinance, a new provision in the form of Section 66(3) has been inserted. It states that if a wrongful trading transaction as stipulated under Section 66(2) has taken place during the exempt period, the RP cannot not file an application before the AA to hold the directors/ partners liable for those transactions.

This would be applicable in the event CIRP is commenced against a corporate person in future (i.e. post exempt period and if default is INR 1 crore, after deducting default amount for exempt period) and is ongoing/ liquidation has commenced.

Under the current unprecedented circumstances, directors/ partners may take certain decisions in the financial interest of their businesses, which could be deemed as wrongful trading transactions, should the entity enter into CIRP in future. However, the insertion of Section 66(3) provides a blanket protection to the directors/ partners for such transactions entered into during the exempt period.

Conclusion

The suspension of Sections 7, 9 and 10 may provide relief to stressed businesses being adversely impacted due to COVID-19. It appears that this suspension would go hand-in-hand with the extended moratorium granted by the Reserve Bank of India (“RBI”) vide press release dated May 22, 2020. The press release can be accessed here. Hence, it would appear that financial creditors would benefit under this scenario.

The brunt of the amendment may be faced by operational creditors or financial creditors who are home buyers. Further, for continuing defaults beyond the exempt period, it may prove difficult to establish aggregate default of INR 1 crore. To proceed under IBC, such creditors would either have to file application jointly (in case of financial creditors meeting requirements under Section 7(1)) or wait till aggregate debt becomes INR 1 crore or CIRP is initiated as a result of some other creditor’s application.

In the alternate they would be required to approach other forums, and the multiplicity of proceedings in various forums may lead to confusion and may prove counter-productive for all stake holders.

[1] The Ordinance can be accessed here.

[2] The press release can be accessed here.

Contributed by Sayli Petiwale, with inputs from Vineet Shrivastava, Astha Srivastava.

Sayli can be reached at sayli.petiwale@aureuslaw.com.